DStv and GOtv’s 40% decoder price cut is the lifeline MultiChoice is throwing to its fraying African fanbase, as the Canal+-owned powerhouse gears up for a November 1 overhaul, slashing costs on entry-level boxes to lure back the millions who’ve ditched premium channels for free-to-air apps and pirated streams.

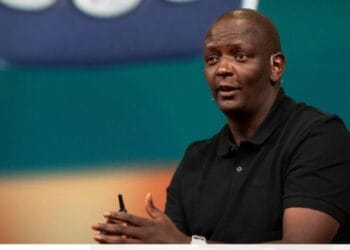

In a bold pivot announced at a glitzy Cape Town media bash, CEO Calvo Mawela framed the move as a “reset for accessibility”, targeting households from Lagos’ bustling markets to Nairobi’s high-rises who’ve bailed amid wallet-pinching economies and Netflix’s siren call.

The numbers paint a grim prelude: MultiChoice shed 2.8 million active subscribers across sub-Saharan Africa in the last fiscal year alone, a bleed blamed on inflation bites, currency crashes in Nigeria and Kenya, and the relentless rise of Showmax rivals.

DStv’s premium decoder, once a status symbol at Sh15,000 (about $115), will drop to Sh9,000, while GOtv’s budget-friendly decoder – the lifeline for low-income families craving a taste of Champions League glory – tumbles from Sh6,500 to Sh3,900.

“We’re not just cutting prices; we’re rebuilding trust,” Mawela told a packed room of journos and influencers, his voice steady over the clink of celebratory Amarula shots. Canal+, the French media giant that snapped up 45% of MultiChoice in a $2.9 billion deal sealed in June, is footing much of the bill, betting on volume over margins to reclaim the continent’s couch potatoes.

Reactions rolled in like a Soweto sunset. In Johannesburg’s townships, where GOtv’s the weekend ritual, Mama mbogas like Thandi Mthembu, 52, lit up her WhatsApp group: “Finally! My kids can watch Peppa Pig without me selling a kidney.”

But sceptics aren’t biting – or subscribing. Consumer watchdogs in Lagos and Kenya decried it as “too little, too late”, pointing to stagnant bouquet prices that still sting at Sh1,500 monthly for basic tiers.

“They slash hardware but hike content – classic bait and switch,” griped analyst Kofi Mensah from Accra’s media desk in his op-ed in The Citizen. This decoder discount dance isn’t isolated; it’s MultiChoice’s countermove in a streaming skirmish where Netflix boasts 3 million African users and TikTok serves bite-sized entertainment gratis.

Canal+’s infusion – promising Sh10 billion in fresh tech like AI-curated playlists and 5G streaming pilots – aims to juice retention, with early trials in Kenya’s Mombasa showing a 25% uptick in sign-ups.

For the 20 million households still tuned in, it’s a breath of fresh air; for lapsed loyalists scrolling YouTube for highlights, it’s a prod to plug back in.

As November’s mercury dips, this DStv and GOtv decoder price cut of 40% feels like MultiChoice’s moonshot – a gamble on goodwill to stem the subscriber haemorrhage. Will it reel in the roamers, or fizzle like last year’s “value bundles”?