Kenya’s AI tax system targets the informal sector with a bold pivot announced Wednesday, as Treasury officials unveiled plans to ditch outdated voluntary reporting for a smart algorithm-driven overhaul, aiming to rope in over 2.5 million hustlers, from street vendors to jua kali welders, into the revenue fold using digital footprints and machine learning magic.

The shift, detailed in a 50-page blueprint from the Kenya Revenue Authority during a closed-door forum at the KRA headquarters, promises to rewrite the rules for an economy where nine out of ten jobs hum in the shadows.

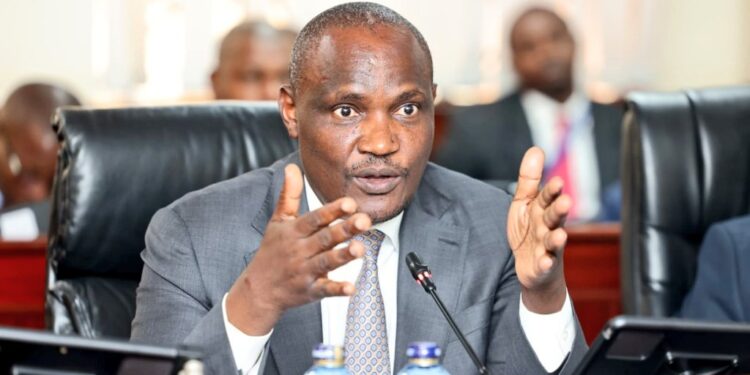

“We’ve relied too long on self-declarations that leave billions untapped,” Treasury CS John Mbadi told reporters afterward, his tie loosened against the humid afternoon air.

“Now, AI sifts through mobile money trails, utility bills, and even social media sales posts to peg fair assessments. It’s not Big Brother; it’s big brains building a fairer net.” The target? That elusive 2.5 million souls in the informal web, from Kibera’s mama mbogas flipping mandazi at dawn to Nakuru’s mechanics tuning matatus under flickering bulbs, folks who’ve dodged the taxman not out of spite but survival.

Under the new Kenya AI tax system targets informal sector blueprint, algorithms would cross-reference her M-Pesa inflows with satellite imagery of market foot traffic and even weather data on rainy day slumps.

“It feels like they’re peeking into my porridge pot,” Amina quipped over roadside chai, half joking, half wary. But proponents counter it’s equity: formal firms like Equity Bank foot 40 per cent of taxes, while informal giants like her collective output rival GDP chunks yet contribute peanuts.

The tech backbone draws from global playbooks, partnering with IBM’s Watson for predictive modelling and local startups like Cellulant for data fusion.

Rollout kicks off in pilot counties like Nairobi and Mombasa by mid-2026, with full steam by 2027, per the roadmap. KRA boss Dr Andrew Kibet painted a rosy horizon: “We’ll use anonymised big data to estimate incomes, offer tiered rates starting at 5 per cent for under KSh 500,000 earners, and automate refunds for overpayers.”

It’s a far cry from the 2023 Finance Act’s blunt hikes that sparked Gen Z fury and street marches. This time, the pitch leans soft: incentives like microloan access for compliant filers, plus AI chatbots in Sheng for query zaps.

Sceptics, though, aren’t biting the byte. At a Thika roundtable Thursday, a small business lobby warned of glitches. “What if the algo mistakes my boda fares for luxury spends? We need audits, not assumptions.”

Yet, the math tempts: the informal sector, per World Bank tallies, clocks KSh 2.5 trillion yearly untaxed, enough to plug potholes from Lamu to Lodwar.

Mbadi dangled carrots: “Bring in 2.5 million, and we slash VAT on essentials by a point. It’s a win-win.” As October 31’s twilight painted Nairobi’s skyline in neon pinks, hustlers scrolled the blueprint on eCitizen apps, a mix of hope and hustle in their eyes.

Kenya’s AI tax system targets the informal sector. It isn’t just code and calculators; it’s a reckoning for a republic where the informal isn’t fringe but the fabric. Will it weave more into the wealth web or snag the smallest threads?