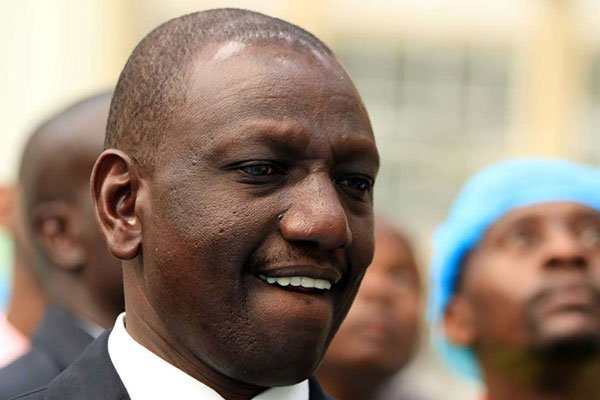

President William Ruto proposes adding Sh1.2 billion to the Kenya Revenue Authority’s (KRA) recurrent budget in order to hire tax agents as he pulls the screws on “hustlers” who have in the past failed to pay taxes.

The committee suggested changes to the National Treasury’s administrative planning and services budget in order to account for the money for the agents’ employment as the government put in place new policies aimed at Kenyans in the informal and agricultural sectors.

In a report to the whole House, the BAC recommended increasing Sh1.2 billion (recurrent) to hire tax aides by KRA.

The untapped earnings base in the Micro, Small, and Medium Enterprises (MSMEs) sector, according to the Treasury’s Budget Policy Statement (BPS) for 2023, has an opportunity to generate Sh2.8 trillion in revenue.

A recently released National Tax Policy (NTP), which will direct Kenya’s taxation system for at least three years, aims to unify both the collection of taxes, levies, and fees and the sharing of data between the national and county governments, netting more people who are not paying taxes and closing existing tax collection loopholes.

Treasury recommended targeting agriculture and the unregulated economy hard in the policy guidelines on hard-to-tax sectors in order to boost tax yields.

According to the policy, “in order to accomplish the aforementioned goal, the government intends to investigate ways to enhance the taxation of informal sectors, including by expanding their presence in large towns and cities, and explore methods for collecting taxes from the informal sector, such as the appointment of tax collection agents.”

In addition, it suggests requiring farmers and members of the unorganised sector to register with the appropriate sub-sector organisations and cooperative societies and distributing tax education packages to these people.

In addition, there is a significant push for information sharing between local and federal governments that will help attract more prospective taxpayers as the government works to increase its revenue.

The policy calls for a gradual departure from the existing structure and might result in the collection of taxes, levies, and fees being handled at a single location rather than at the county and federal levels as they do now.

The NTP recommends “progressively adopting a unified system for the collection of taxes, fees, and levies for the national and county governments.”

Several areas where counties now collect taxes, fees, and levies would alter as a result of this proposal, including parking costs, business licences, such as single business permits and cess, and parking fees.

Additionally, it would affect the counties’ own source revenue (OSR), because most of the units that have been devolved have had low performance and weak capacity in their own revenue collection, which has not returned much from their abundant resources.

According to a study published by the Commission on Revenue Allocation last year, the 47 county governments of Kenya were only collecting Sh31 billion a year, which was an underperformance of more than 80%. They had the capacity to earn Sh216 billion annually.

The KRA only collected Sh1.57 trillion in taxes at the end of April, placing pressure on the government to raise at least Sh535 billion in taxes in the last two months of the 2022–23 fiscal year.

This will be a difficult challenge for the taxman given that the Sh535 billion it has to raise to reach the Sh2.1 trillion objective set out in the budget is 70% greater than the average collection for the 10 months prior to April.