Dr. David Ndii, the Chairperson of the Council of Economic Advisors, announces an increase in the tax-free income band from the current Kes 24,000 to Kes 36,000, with a medium-term target of Kes 45,000.

According to the statehouse finance committee expert, Finance Bill 2025 will be for hustlers.

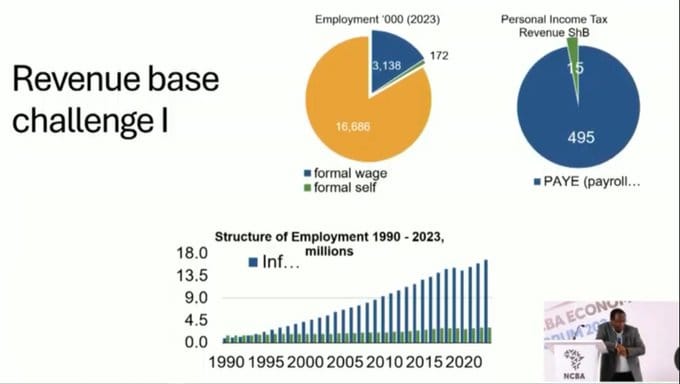

According to David Ndii’s report on expanding the tax base, 3.1 million individuals who paid PAYE contributed approximately KES 495B last year.

In the meantime, approximately 16 million individuals who are formally self-employed have only paid approximately KES 15B. The latter should be paying around KES 500B.

“So our taxes (cbk deposits) give commercial banks loans to invest in government bonds (domestic debt), and the government comes back to us for more taxes to pay interest (on our money) for those bonds! Ponzi scheme/pyramid scheme, unadulterated theft?” Jimi Wanjigi said.

The KRA will implement enhanced regulations for mobile devices to strengthen tax compliance, starting January 1st, 2025.

Several regulations were set by KRA, and the following will apply:

1. All importers are required to submit detailed import entries that include accurate quantities, comprehensive model descriptions, and the respective International Mobile Equipment Identity (IMEI) numbers for each mobile device.

2. Device assemblers and manufacturers must register on the KRA Customs portal and submit a report of all devices assembled for the local market, along with their respective IMEI numbers.

3. Passengers entering Kenya will also be required to declare their mobile devices on the F88 passenger declaration form, providing the necessary details and IMEI numbers for devices intended for use during their stay.