It appears that Whitepath Company Limited, already warned by the Office of the Data Protection Commissioner (ODPC) for breaches, is only raising its pushy methods.

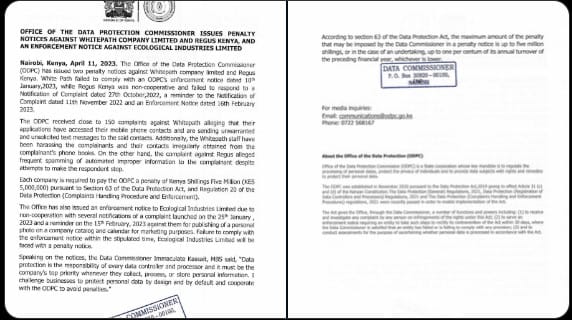

Despite getting penalty letters in April 2023 for complaints about unwanted texts and harassment, the company’s behaviour has worsened, with borrowers’ contacts regularly being viewed and bullied upon failure.

A tipster has revealed that Whitepath charges a frightening 35% interest per week and quickly targets borrowers contacts with dangerous texts as soon as a failure happens.

Some customers say that the company’s actions have driven them to the edge, with many saying that the abuse has caused them a lot of stress and even suicidal ideas.

“Please hide my ID.” “Whitepath Company Limited is a loan company that has been bothering its clients. I’d like to bring this to your attention. People who take money from this company are known to be blackmailed.

“If you fail on a payment, they instantly text your contacts, bothering them with requests for payment. They charge up to 35% interest per week, which is an expensive rate and can drive people to extreme measures, including suicide ideas.

“Despite being fined and warned by the Office of the Data Protection Commissioner (ODPC), Whitepath has only gotten worse. We still don’t know how they get into their clients’ contacts, and there are still questions about who owns the business. I hope that you can show how they are greedy so that other people don’t get hurt the same way,” an insider told blogger Nyakundi.

that white path needs to be closed they have been calling me frequently concerning a loan I don’t know anything about claiming that my number was put as a collateral.honestly cbk needs to intervene