Starting in February 2026, employees whose NSSF contributions exceed Sh100,000 will need to remit an additional Sh2,160 monthly, raising their total deduction from Sh4,320 to Sh6,480 and reducing their net take-home pay by Sh1,512 after accounting for employer matching.

The adjustment arises from the phased rollout of the NSSF Act 2013 rates, which set contributions at 6 per cent for both employees and employers based on pensionable earnings up to the maximum threshold. Beginning in February, the minimum earnings threshold increases to Sh7,000, while the maximum threshold rises to Sh54,000, substantially affecting higher earners who were previously restricted to lower brackets.

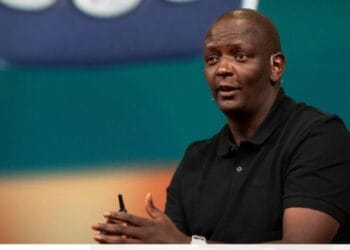

Labour Cabinet Secretary Alfred Mutua affirmed the course of action during a stakeholders’ forum in Nairobi, noting that the phased implementation permits sufficient adjustment time following court disputes that postponed full enforcement for several years.

He confirmed that the additional funding will enhance retirement resources, benefiting millions as they reach pension age in the context of increasing life expectancy.

Employees presently within the Tier II framework, applicable beyond the minimum threshold, encounter the most significant increase. For an individual earning Sh150,000 per month, the aggregate contribution increases to Sh12,960, divided equally, thereby reducing the net salary unless employers mitigate the increase through negotiations.

Trade unions expressed support for the long-term security improvements while advocating for supplementary measures such as tax relief on contributions to mitigate immediate shortfalls. Central Organisation of Trade Unions Secretary General Francis Atwoli called for dialogue to support low-income members still covered under Tier I.

Financial advisors advise impacted employees to evaluate their budgets, prioritise essential expenditures, and consider supplementary voluntary savings programmes. Retirement planning firms observe that the mandatory increase encourages discipline, potentially enabling the accumulation of significant nest eggs over decades through the power of compound interest.

The Employers Association of Kenya emphasised the expenses associated with compliance while recognising the collective responsibility in ensuring the future stability of the workforce. Members draft correspondence to staff outlining statutory obligations and investigating wellness initiatives to mitigate perceived salary reductions.

The National Social Security Fund anticipates that increased collections will expedite infrastructure investments in real estate and equities, resulting in improved returns for members. Recent reports indicate enhanced governance and digital services leading to a reduction in claim delays.

Young professionals in urban centres exhibit ambivalent sentiments, appreciating potential future advantages while contending with current affordability challenges due to elevated living expenses. Many depend on the mandatory scheme as their primary retirement mechanism, with limited access to private pensions.

Government actuaries assert that the rates are sustainable and consistent with regional benchmarks, where comparable percentages are applied without limits in certain countries. They commit to conducting regular evaluations to reconcile the responsibilities of contributors with the sustainability of the fund.

As February approaches, payroll service providers conduct webinars to facilitate implementation, ensuring a seamless transition for numerous organisations. Compliance notices are distributed, informing defaulters of penalties of up to 5 per cent per month.

The NSSF contributions exceeding Sh100,000 for staff in February 2026 signify another advancement towards comprehensive social protection within Kenya’s developing economy. Although immediate take-home reductions concern many, supporters contend that enhanced retirement safety nets validate the sacrifice in pursuit of long-term financial independence. Workers are now reassessing their expectations, adjusting to the new reality of increased mandatory savings during uncertain times.