A newly registered Polymarket account spent $30K only one day before the US captured Nicolás Maduro. This trader has now won $400K 24 hours later. The bet sparked widespread talk of possible insider information after the US military operation took place early on January 3, 2026.

The account, linked to wallet address 0x31a56e9E690c621eD21De08Cb559e9524Cdb8eD9, was created in late December 2025. It placed several bets on Venezuela-related outcomes. These included Maduro being out of power by January 31, US forces in Venezuela by that date, and Trump invoking war powers against Venezuela.

The total stake reached about $32,000 to $34,000 across the positions. Odds were low at the time, around 6–11% for Maduro’s removal.

Hours later, President Donald Trump announced the capture. US forces raided Caracas and took Maduro and his wife into custody. They were flown to New York to face federal charges tied to drug trafficking and narcoterrorism.

The market resolved in favour of the bettors. The winning account cashed out over $436,000, netting roughly $400K in profit. Blockchain data shows the funds were withdrawn to Solana soon after.

The timing raised red flags. The bets clustered just before the announcement. The account focused only on Venezuela events. Online sleuths and reporters noted the pattern.

NPR, BBC, Reuters, and others covered the story as a potential case of advance knowledge. Some called it suspicious. Others said it could be a lucky guess based on public rumours or analysis.

Two weeks before the win, similar reports highlighted an apparent insider who bet on Maduro losing power. That earlier coverage noted the $400K figure. Now, the connection to the recent trade has fuelled more scrutiny.

On January 14, Trump said the leaker in the Venezuela case has been identified and is in jail. He spoke in the Oval Office. The president described the person as “very bad” and hinted more arrests might follow.

Sources point to a Pentagon contractor named Aurelio Perez-Lugones. He faces charges for unlawful retention of national defence information. He allegedly leaked details to the Washington Post about the operation.

The Polymarket account linked to the bet appears to have been deleted. Users trying to view the profile now see an error message: “Oops… we didn’t forecast this.” The page is inaccessible.

Polymarket has not commented on whether the user deleted it, requested removal, or if it was a glitch. Their privacy policy allows users to ask for data deletion.

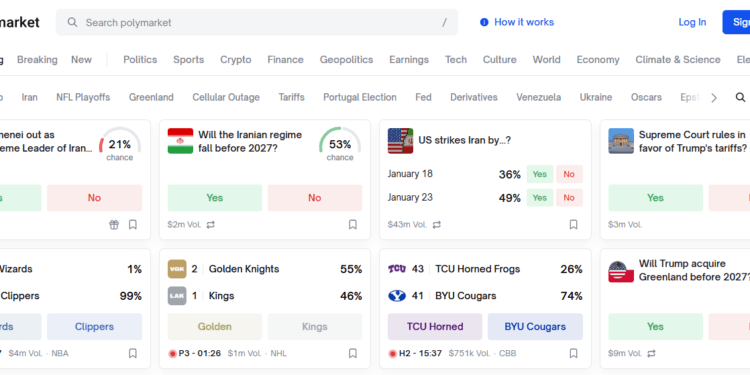

This case has put prediction markets back in the spotlight. Polymarket operates as a crypto-based platform for betting on real-world events. It faced CFTC action in the past but relaunched with approvals.

Critics say it lacks strong rules against insider trading. Kalshi, a regulated rival, bans such activity. Lawmakers like Rep. Ritchie Torres have introduced bills to limit government officials from betting on related outcomes.

The Maduro operation itself stirred debate. Trump called it a decisive move against a regime tied to drugs and gangs. Venezuela saw unrest after the capture. The US has taken steps to influence events there.

The $400K win shows how prediction markets can move fast on big news. Whether it was skill, luck, or something more remains unclear. The trader’s quick exit adds to the mystery. Regulators and the public keep watching as these platforms grow.