|

| KPLC workers on a power transmission line. PHOTO | BDA |

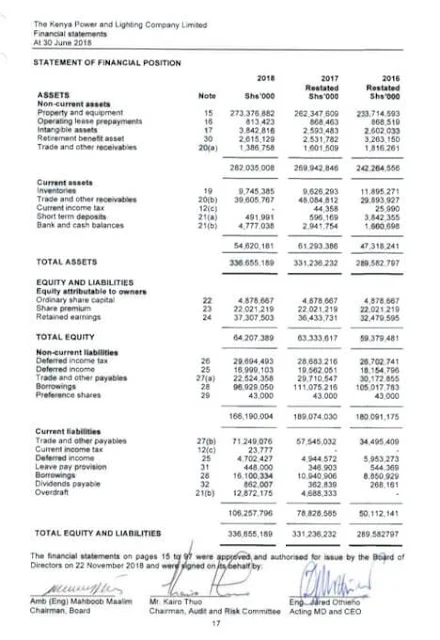

Despite Kenya Power being a power transmission monopoly in Kenya, The company has declared a decline in profit for over 90% compared to 2018/2019 financial year.

KPLC has posted a 91.98% decline in net profit to Sh262 million from Sh3.27 billion for the financial year ended June 2019 on the high cost of buying electricity from the electricity generators.

Notwithstanding revenue rising by 1.34% to Sh133.1 billion on more electricity sales, increased power purchase and higher finance costs dented its bottom-line.

“This was mainly attributable to increase in non-fuel power purchase costs by Sh18 billion from Sh52.7 billion to Sh70.8 billion following the commissioning of two power plants with a combined generation capacity of 360MW during the period,” said Kenya Power.

“Besides, finance costs rose by Sh3.2 billion due to increased levels of short term borrowings and foreign exchange losses.”

Power purchase costs, including fuel and foreign exchange costs, increased by Sh6 billion to Sh90.1 billion.

Post a Comment

What is your say on this