Kenya’s betting SHIF, pension (NSSF), and housing deductions for 2025 are reshaping the gambling landscape as millions of punters prepare to channel a slice of their stakes and winnings into mandatory social savings.

The Betting Control and Licensing Board (BCLB) announced the policy shift on November 1, mandating that licensed operators withhold contributions for the Social Health Insurance Fund (SHIF), Affordable Housing Levy, and National Social Security Fund (NSSF) directly from every bet placed and payout issued.

This move, greenlit by Treasury Cabinet Secretary John Mbadi under the Finance Act amendments, aims to bolster national welfare funds amid rising fiscal pressures, but it has sparked backlash from the industry and bettors alike.

The deductions, set at a combined rate of 2.75 per cent for SHIF, 3 per cent for housing, and up to 6 per cent tiered for NSSF on qualifying winnings, will apply across all platforms from SportPesa to Betika.

For a typical Sh1,000 stake, punters could see up to Sh118 shaved off before the bet even runs, with similar cuts on any returns.

“This is not taxation in disguise; it’s enforced savings to secure futures for our youth hooked on quick wins,” BCLB CEO Peter K. Mbugi said in a Nairobi press conference, flanked by representatives from the Kenya Revenue Authority (KRA).

He emphasised that the regulator’s new powers stem from a gazette notice empowering BCLB to enforce compliance, ensuring funds flow seamlessly to the Social Health Authority and NSSF coffers by the 9th of each month.

Industry insiders paint a grimmer picture. Kenya’s betting sector, already reeling from a 5 per cent excise duty hike on deposits introduced in July, now faces potential revenue dips as operators absorb administrative costs.

“We’re talking about Sh2 billion annually rerouted from circulation, hitting small firms hardest,” lamented a mid-tier bookmaker during a virtual stakeholder forum.

Data from the BCLB shows Kenyans wagered Sh88.5 billion last year, generating Sh6.64 billion in taxes alone. With this policy, experts predict a 10 to 15 per cent drop in activity, echoing a similar slump after the 2023 withholding tax surge on winnings.

Social media erupted with memes and rants, one viral post reading, “Bet on Man U, wake up funding my neighbour’s house and health card.”

The policy’s roots trace back to broader 2025 fiscal reforms. SHIF, launched in October to replace the National Health Insurance Fund, demands 2.75 per cent from gross incomes, now extended to gambling proceeds deemed “informal earnings”.

The housing levy, paused briefly by court challenges but reinstated in March, targets 1.5 per cent matched contributions for affordable units.

NSSF’s third-phase rollout in February upped employee deductions to 6 per cent on earnings up to Sh72,000, with employers matching.

By folding betting into this matrix, the government addresses a loophole where high rollers evaded contributions. “Gambling winnings are income, plain and simple. Why should they skip the social safety net?” posed an economist in a Capital FM interview, citing parallels with Uganda’s 2024 gaming levy reforms.

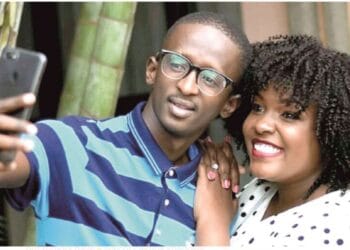

Bettors, predominantly young men in urban hubs like Nairobi and Mombasa, feel the pinch acutely. A survey by the Kenya Institute for Public Policy Research and Analysis (KIPPRA) last month found 62 per cent of respondents betting weekly to supplement incomes averaging Sh25,000.

“I stake Sh500 twice a week for school fees. Now it’s like the house always wins before the game starts,” shared anonymous punter Jamal from Eastlands, echoing sentiments in WhatsApp groups buzzing with boycott calls.

Advocacy group GamCare Kenya warned of heightened addiction risks, as reduced net payouts could drive underground betting rings, already a Sh10 billion shadow economy per police estimates.

Government defenders counter that the deductions build equity. “In a nation where 36 percent live below the poverty line, every shilling counts toward universal health and pensions,” Mbadi said, linking to a portal for tracking contributions.

Early compliance figures are promising: Over 200 operators registered for automated remittance systems within 48 hours, per KRA logs.

Will this curb the gambling fever gripping 14 million adults or fuel resentment in a cost-of-living crisis? For now, punters recalibrate strategies, operators tweak apps for transparency, and policymakers eye the revenue windfall projected at Sh1.5 billion yearly.