Nairobi Sidian Bank’s health fund shift from Co-operative Bank has thrust the county’s public hospitals into a whirlwind of controversy.

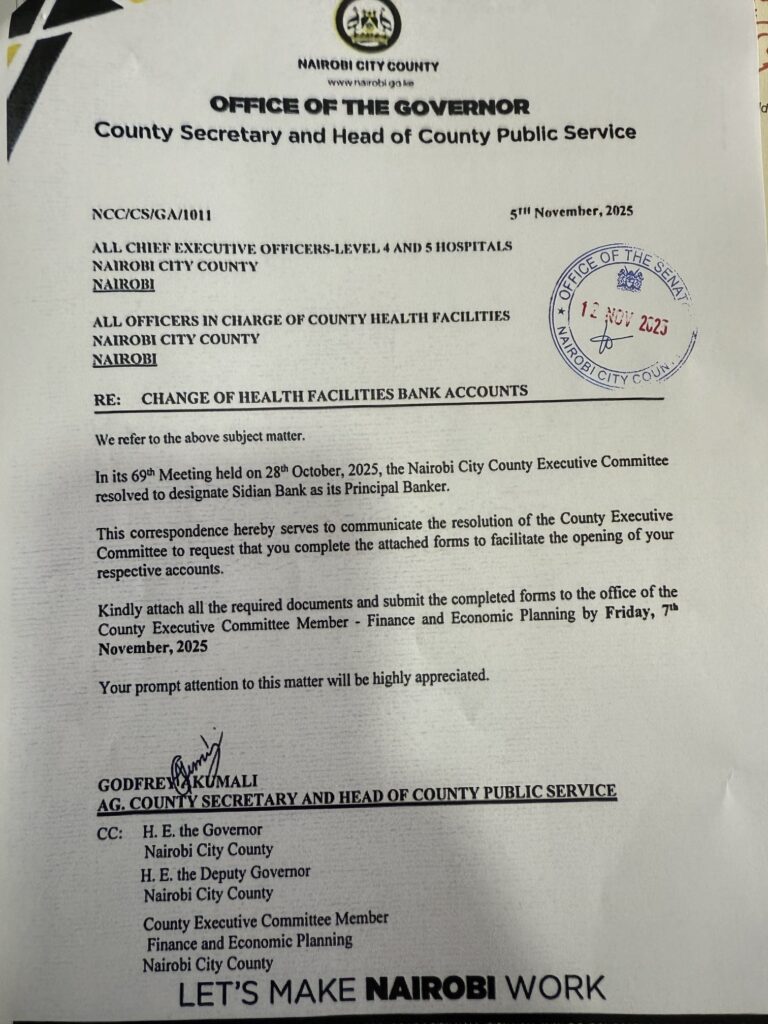

The county government orders Level 4 and 5 facilities to reroute billions in transactions to the Tier 3 lender, ditching longstanding ties with Co-operative Bank.

The directive, greenlit in an October 28 county assembly resolution, mandates hospitals like Kenyatta National and Mbagathi to open principal accounts at Sidian by November 7, streamlining health payments but igniting accusations of backroom deals and procurement foul play.

With deadlines looming just days away on November 12, civic watchdogs and opposition voices are mobilising, turning what should be a routine financial tweak into a flashpoint for transparency battles in Kenya’s devolved health system.

The shift affects over 20 major facilities, channelling an estimated Sh15 billion annually in reimbursements, salaries, and supplies through Sidian, a smaller player with roots in microfinance but recent ambitions in commercial banking.

The county health executive defended the move in a terse November 11 briefing: “This consolidates funds for efficiency, cutting delays in service delivery.”

Yet, the abrupt pivot from Co-operative Bank’s robust network – home to hospital accounts for nearly two decades – raises eyebrows.

Forms for new setups, distributed via county memos, demand swift compliance, with non-adherence threatening funding freezes that could hobble emergency wards and maternal care units.

Senator Edwin Sifuna, Nairobi’s vocal representative, didn’t hold back in a fiery Senate address on November 12, branding the resolution “textbook corruption”.

“The health facilities in Nairobi have been banking with Co-operative Bank, a tier one bank with a solid history and reputation. How you wake up one day and direct all of them to move to a tier 3 bank cannot be explained any other way than that corruption is at play,” Sifuna thundered, linking the decision to shadowy influences.

His crosshairs zeroed in on Farouk Kibet, a close Ruto associate often whispered to be a deal-broker, and Sidian’s fresh board lineup featuring ex-Health CS James Macharia as chairman – an appointment sealed weeks before the resolution.

“This smells of favouritism, not fiscal smarts,” Sifuna added, vowing to summon county bosses for parliamentary grilling.

Bunge La Mwananchi, the grassroots outfit known for challenging land grabs, filed a High Court petition on November 11, alleging procurement violations under the Public Finance Management Act.

“No tender, no transparency – just a rubber-stamp vote,” the spokesperson told journalists outside Milimani Law Courts, flanked by medics in scrubs holding placards reading “Heal Us, Don’t Steal From Us.”

The suit seeks an injunction, arguing the shift bypasses competitive bidding and exposes patient funds to a lender with a spotty track record on digital security, per Central Bank audits.

Whispers of deeper ties swirl. Sidian’s 2024 pivot from niche lending to public sector bids coincided with Ruto’s post-election cabinet purge, where allies like Kibet gained sway.

Co-operative Bank’s ouster, despite its Sh200 billion asset base, fuels theories of payback for past loan resistances.

Hospital admins, caught in the crossfire, voice quiet concerns: an Mbagathi source confided to Nation, “We’re loyal to patients, not politics. This could snag drug supplies mid-month.”

Patients, too, feel the chill – Nairobi’s overburdened wards, serving 5 million residents, can’t afford disruptions amid a Sh10 billion county health deficit.

As deadlines bite, Nairobi Sidian Bank health fund shifts in 2025 expose the fraying threads of devolution’s promise. Will courts halt the handover, or will billions flow unchecked?